All Categories

Featured

Table of Contents

Interest will be paid from the date of death to date of repayment. If fatality is due to all-natural causes, death earnings will certainly be the return of premium, and rate of interest on the costs paid will go to an annual effective rate defined in the plan agreement. Disclosures This policy does not assure that its profits will certainly be adequate to spend for any type of certain solution or goods at the time of demand or that solutions or merchandise will certainly be supplied by any kind of specific supplier.

A complete declaration of insurance coverage is found just in the policy. For even more information on coverage, expenses, limitations; or to get coverage, contact a local State Farm agent. There are constraints and conditions concerning payment of advantages as a result of misstatements on the application. funeral and burial insurance. Dividends are a return of costs and are based upon the actual mortality, cost, and investment experience of the Firm.

Irreversible life insurance policy develops cash money value that can be borrowed. Policy financings accumulate rate of interest and unsettled plan fundings and rate of interest will certainly lower the fatality advantage and cash money worth of the policy. The amount of cash worth readily available will usually depend upon the sort of long-term policy acquired, the quantity of protection purchased, the length of time the policy has been in force and any type of superior policy fundings.

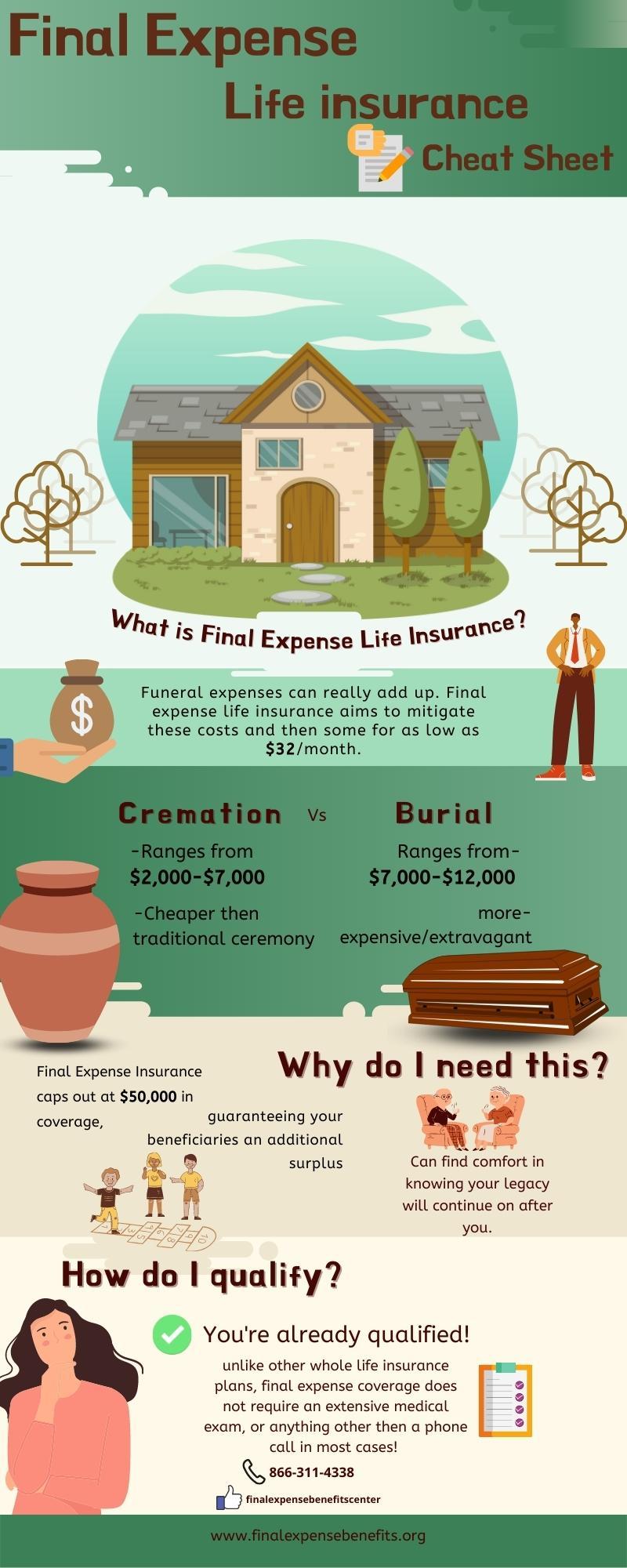

Associate links for the items on this web page are from partners that compensate us (see our advertiser disclosure with our list of companions for even more details). Our point of views are our own. See just how we rank life insurance policy items to write unbiased product evaluations. Funeral insurance coverage is a life insurance coverage plan that covers end-of-life costs.

Interment insurance requires no medical examination, making it easily accessible to those with medical problems. The loss of a loved one is emotional and stressful. Making funeral prep work and discovering a way to spend for them while regreting includes another layer of stress. This is where having interment insurance policy, likewise known as last cost insurance policy, comes in useful.

Simplified concern life insurance calls for a health and wellness assessment. If your health and wellness standing disqualifies you from traditional life insurance policy, burial insurance may be a choice.

Lead Bank Final Expense

, funeral insurance coverage comes in a number of types. This plan is best for those with moderate to moderate health problems, like high blood stress, diabetes, or bronchial asthma. If you don't desire a clinical exam but can qualify for a simplified concern plan, it is typically a better offer than an ensured problem plan since you can get even more coverage for a more affordable costs.

Pre-need insurance policy is high-risk due to the fact that the beneficiary is the funeral home and coverage is particular to the chosen funeral home. Ought to the funeral home go out of service or you vacate state, you may not have coverage, and that beats the function of pre-planning. Additionally, according to the AARP, the Funeral Service Consumers Alliance (FCA) encourages against getting pre-need.

Those are essentially interment insurance plan. For assured life insurance policy, costs estimations depend on your age, gender, where you live, and coverage amount. Understand that insurance coverage quantities are restricted and vary by insurance coverage carrier. We discovered sample quotes for a 51-year-woman for $25,000 in insurance coverage living in Illinois: You may determine to pull out of interment insurance if you can or have conserved up adequate funds to pay off your funeral and any superior financial debt.

Burial Insurance For The Elderly

Funeral insurance offers a simplified application for end-of-life coverage. A lot of insurance policy firms need you to talk to an insurance policy representative to apply for a plan and acquire a quote.

The goal of having life insurance policy is to alleviate the burden on your liked ones after your loss. If you have a supplementary funeral service plan, your liked ones can use the funeral policy to deal with last costs and get a prompt dispensation from your life insurance policy to manage the home loan and education expenses.

People who are middle-aged or older with clinical problems might take into consideration burial insurance coverage, as they may not get approved for conventional policies with more stringent approval criteria. Furthermore, funeral insurance coverage can be useful to those without extensive savings or typical life insurance policy coverage. lincoln final expense. Burial insurance coverage varies from various other sorts of insurance policy because it provides a reduced survivor benefit, generally only sufficient to cover costs for a funeral service and various other connected prices

News & Globe Record. ExperienceAlani is a former insurance fellow on the Personal Money Insider group. She's examined life insurance policy and family pet insurer and has composed many explainers on travel insurance policy, credit history, financial debt, and home insurance coverage. She is enthusiastic about debunking the intricacies of insurance and various other individual money subjects to ensure that visitors have the info they need to make the best money decisions.

Burial Insurance Canada

The more protection you get, the greater your costs will be. Last cost life insurance policy has a number of advantages. Namely, everyone that applies can obtain approved, which is not the instance with various other sorts of life insurance coverage. Last cost insurance is frequently suggested for seniors who may not qualify for traditional life insurance policy because of their age.

Furthermore, final cost insurance is useful for people that intend to spend for their very own funeral. Funeral and cremation services can be expensive, so final cost insurance coverage offers satisfaction recognizing that your liked ones will not need to use their savings to pay for your end-of-life setups. However, final expenditure coverage is not the ideal item for everybody.

Getting whole life insurance coverage through Ethos is quick and easy. Insurance coverage is offered for senior citizens between the ages of 66-85, and there's no clinical examination required.

Based on your actions, you'll see your estimated price and the quantity of insurance coverage you get approved for (between $1,000-$ 30,000). You can buy a policy online, and your insurance coverage begins immediately after paying the first costs. Your price never ever alters, and you are covered for your whole lifetime, if you proceed making the month-to-month payments.

Final Expense Insurance California

Final expense insurance coverage provides advantages but requires cautious factor to consider to identify if it's ideal for you. Life insurance policy for last expenses is a type of long-term life insurance coverage made to cover expenses that occur at the end of life.

According to the National Funeral Directors Organization, the average price of a funeral service with funeral and a watching is $7,848.1 Your enjoyed ones could not have accessibility to that much money after your fatality, which can add to the tension they experience. Additionally, they might experience various other prices related to your death.

It's typically not pricey and fairly very easy to obtain (select advisor life insurance). Final cost coverage is in some cases called funeral insurance coverage, yet the money can spend for practically anything your liked ones require. Recipients can make use of the fatality benefit for anything they require, allowing them to attend to one of the most pressing monetary priorities. Oftentimes, loved ones invest cash on the adhering to things:: Spend for the burial or cremation, viewing, location service, officiant, blossoms, providing and extra.

: Work with experts to assist with handling the estate and browsing the probate process.: Liquidate accounts for any kind of end-of-life treatment or care.: Settle any type of various other financial obligations, consisting of vehicle financings and credit rating cards.: Beneficiaries have full discretion to make use of the funds for anything they require. The money can even be made use of to create a heritage for education expenditures or donated to charity.

Latest Posts

Life And Funeral Cover

Whole Life Insurance Final Expense Policy

Burial Insurance For Parents Over 80